Offshore Yuan, Renminbi, CNH, CNY, What The Hell Are They?

By Santana Nyekano. August 9th, 2016

Every country has its significant currency for the purposes of international recognition and trade.

Most of the currencies widely known are the American dollar ($), Rupee for India (Rs), Pound for the United Kingdom (£) while China has the Chinese Yuan.

During the foundation of China in the year 1949, the ruling party at that time introduced the Renminbi as the officially recognized name of the currency to be used in the state.

In its most elementary description, it simply stands for “the people's currency”. While the Yuan is the nationally recognized denomination unit, the Renminbi is the money transacted in by the People's Republic of China (PRC).

What is the China Offshore Yuan

In China, the Renminbi (RMB or CNY) is the official legal medium of payment in mainland China.In English, it lacks a direct code of reference, but locally it promotes national unity and instills a sense of ownership among the citizens.

It is referred to as the “yuan” in Chinese spoken word. Thereby, CNH is the currency while CNY is the denomination.

Eventually, after the financial crisis that shook the economy of China in 2008, the People's Republic of China took the initiative of ensuring that the Chinese Yuan was recognized internationally and used across the board.

The primary motive behind this move being to make sure that it was the accepted currency of choice by all. Another reason was to promote its conversion to other currencies.

The offshore Renminbi started gaining popularity in the country and abroad when China took on a worldview when it came to the way fiscal policy was approached and executed.

This sort of transition was done purposefully so as to make way for smooth economic and financial transactions. It was the first sign that China was strategically opening up its economy at a time an internationally recognized and accepted means of exchange was required.

Hong Kong was the center for trade. Due to its strategic position, it was chosen to maintain the economic significance to the offshore Yuan. Stepping in to follow suit, other cities like Singapore and London also set up their markets, a replica of the offshore Renminbi markets.

Renminbi Market

Locally, the Renminbi was used as the principal means of exchange in financial trading. On the international scope, it was leveraged to fulfill bigger purposes.China stands out among the fast developing economies internationally with ever increasing and developing market opportunities.

Speculatively, though, the (PRC) is bound to outshine the United States of America and be the leader in world's economy in a decade or so. Their current position of second largest in economic size is due to their global economic growth.

The PRC would have to carry out a massive restructuring of most of its international trade factors in the wake of internationalizing the Renminbi.

It will be an added advantage to the state in promoting its acceptance by the international community as a major contributor to global liquidity. It will need to bring a smooth balance to all vital aspects controlling her economy.

It will also need to build a strong back-up to support its financial requirements, creating viable means of access to it by other markets globally.

Also, it will need to create a flexible, manageable and consumer-friendly exchange rate to the economy. All these are viable measures which if accomplished, will ensure a smooth ascent to international status.

Another significant advantage to the PRC on internationalizing of the Renminbi is that it will be a possible solution to the frequent shortages of products on the international market.

The PRC will be a universal savings solution. It will be able to provide corporations, individuals and even national banks with banking services. Whenever the need arises, the respective account holders will be able to withdraw their funds at will on liquid funding requirements.

The world has positively accepted the PRC's rise to global status as an icon in promoting asset and security financing. It is a position that has been single-handedly controlled by the United States for a very long time.

It is in fostering this development that the PRC through the Renminbi is providing an alternate solution to the world's economic control. It has been a topic of concern considering that the global financial standards are pegged on the liquidity of a single country, the United States of America.

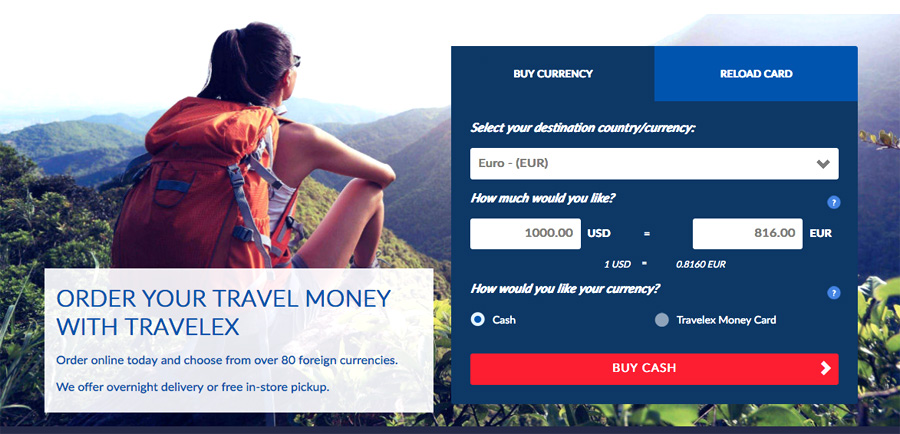

Check the Latest Rates Here⬇

By internationalizing the (RMB), the PRC provides the most viable solution to boost what the United States of America can provide to the international market. Fortunately, the successful internationalizing of the Chinese Yuan will possibly support the prospective globalization of the international economic aspects.

Internationally on the economic forum and currency use in financial transactions, the RMB holds the sixth place by value.

Before the offshore concept, the currency held the fourth position globally, but gradually slipped down.

The economic growth decline is caused by the immediate risks in the foreign market exchange rates. It thereby changed the international investors' initial plans to use the currency at hand.

If China manages to maintain the lead in economic trends, the Yuan will most likely be among the top international currencies. Currently, the Chinese Yuan is valued at 6.6 against the dollar. It attained this position after a slight weakening of 0.51 percent.

Onshore and offshore currencies

As China’s economy continues to improve globally, there is considerable need to learn and understand more about its trading currencies.As shown earlier, the Yuan, better known as the Renminbi, is authorized by the state’s National Bank as the denominational exchange medium.

Incidentally, just as you wouldn’t say an item costs one sterling, but one pound, is the same way in which it wouldn’t be correct to say that an item costs one Renminbi, but you would say it costs one yuan.

This denomination is fast gaining importance globally to an extent that the International Monetary Funds has given it a face value by announcing that it is now being identified as a global trading medium.

As for the CNY and the CNH, both initials are authorized codes for the yuan, though, in regional trademarks, the CNY is more identified with the onshore currency of China while the CNH identifies with the foreign money.

It just means that the CNY holder can only trade with it on the mainland of China whereas, the CNH purchases only off the land. The main distinction between the two is that, while the People’s Bank of China does not allow free movement of the Yuan on land, the CNH has the freedom to move and circulate without restrictions whatsoever.

The CNY has never floated on a free currency basis because of how its movement is controlled by the PBoC, and it was initially attached to the dollar at a low value of 2.46.

A slight freedom in the year 1980 enabled it to gain against the dollar up to 1.50, but later lost its ground drastically to a poor value of 8.62.

In the year 2005, during a value reassess, it rose slightly 8.11 against the dollar and got associated with a thin trading band on which the US currency was based. Here, it gained value by a remarkable 30 percent. At a recent date, the trading gap was increased by a notable two percent from the first one percent.

However, the country's national bank, PBoC, still applied its rather heavy fiscal authority to ensure that the currency passed through the rigorous daily routine modeled to oversee uneventful changes of the coin, be it appreciation or depreciation suitable to the bank’s requirements.

The year 2005 marked a remarkable milestone in Chinese economy and eventually had adverse effects on the global market. China released its economy to the world forum for international trading. Its actions finally released the trading currency too.

The international landscape prompted China to model a way of transacting with Yuan cautiously without opening up its capital accounts to the risks of financial reductions.

Creation of the CNH

The first measure to be taken by the Government of China was that the red-tape preventing private banking deposits into Hong Kong was lifted allowing all currency deposits from individual account holders to float freely.By then, the international trade center based in Hong Kong, which was initially taken by the United Kingdom had already been returned to China. Over time, with the continuous growth of Yuan or Renminbi, the bond markets improved, and the personal deposits increased in size.

The offshore exchange denomination took a deeper role within the international market and started getting used widely and actively in trade.

It is now very present in cities like Taiwan, London and Singapore. The fast-growing international exposure allowed Chinese controllers to ease the rules and regulations controlling the onshore currency.

After the two outstanding events, China finally came up with two distinct money systems. Each had its separate mode of operation very much different from the other.

The movement of goods, services, and the exchange medium on the mainland remained under strict watch and control by the PBoC. This means it gave way only to the internal residents of China to trade or move goods through the borders of the country freely.

Besides that, it only allowed conversion of current accounts only while barring capital accounts conversions. Basically, it allowed internal trade only while restricting any form of investment or banking related activities.

Value

In comparing the two, the CNH is allowed the freedom to float freely without restrictions on transactions on any trade agreements that move across China's borders.On the other hand, the red-tape placed on transactions regarding the on-land currency remained in place with minimal changes.

By default, due to the significant differences in the mode of circulation and level of freedom, the two currencies eventually recorded noticeable rate differences to the dollar.

However, to iron things out and bring a level ground to the developing cost differences from the same country, the country's national bank, the People's Bank of China again waded into the situation by entering into the CNH's diverse market. This action aims at curtailing some of its much-enjoyed freedom and bringing it in sync with highly controlled CNY.

Place in World Finance

The International Monetary Fund (IMF), made that request in the general concern of ironing out the two currencies' differences in rates and value. It was necessitated by China's move of internationalizing its currency.The IMF made this request after laying down the procedures to be undertaken in having China's currency as one of its principal currencies set aside for reserve purposes.

The timely and necessary action by PBoC and the IMF turned out very effective in that the differences in trade rates of both the onshore and offshore currencies were reduced and smoothed out, bringing both of them to an almost equal value of 6.54 in relation to the United States' trade currency.

New developments in offshore Renminbi

In line with the notable changes being recognized like the increase in the offshore deposits, soon it will be known to what extent these fiscal measures are going to be felt both within the country and internationally.

It must be noted that the outburst in offshore deposits is prompted by the difference in the value of the onshore and offshore Renminbi.

Another point to note is that this response might also have been brought about by the behavior of importers and exporters. When the value of CNH was more than that of the CNY, investors in China imported from Hong Kong thus increasing CNH deposits, and when CNY grew in value more than CNH, the investors spent their earnings on the mainland, which had the effect of reducing their CNH deposits.

Notably, though, due to the ever-increasing spread of Westernization, and the deep-rooted effect that western societies have in many countries abroad, you shouldn't be surprised to visit China and fail to hear the terms Yuan or Renminbi being extensively used. The reason behind this being that most Chinese citizens use the word “Kuai”, pronounced kwai.